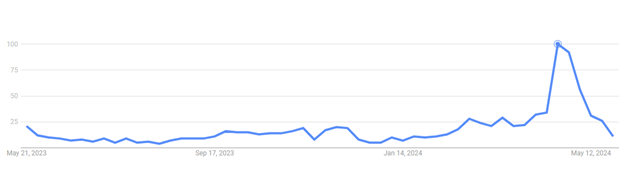

The word “Stagflation” can strike fear into the hearts of consumers and investors. Painful memories of the 1970’s U.S. economy with its high inflation along with uneven growth quickly come to mind. Recent volatile inflation data and cooling GDP results have understandably resurrected these fears for many. Google searches for the term stagflation recently spiked after higher-than-expected March consumer price index measurements were released on April 10, 2024.

Source: Google search trends for the term “Stagflation”, 05/27/2024

Our FAS Wealth Partners update will discuss what occurred during the 1970s, where we are now with regards to the current economic landscape and why we feel the odds of a similar stagflationary environment are lower.

The 1970s

To begin we will spend most of this piece reviewing the inflationary backdrop experienced beginning in the 1970s through the early 1980s. Starting in 1968, inflation began to run at a rate of ~5% with 1972/1973 being notable exceptions until 1974 when inflation spiked to over 8%. From that year on, inflation was measured to be well over 5% reaching as high as 12.6% then receding to below 5% in 1983.

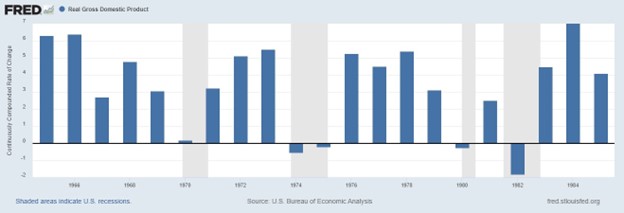

Over the same period, economic growth as measured by real GDP was significantly uneven with recessions occurring 4 times (shaded gray areas) between 1970 and 1982.

Additionally, unemployment was stubbornly high, jumping to 8.5% in 1975 from slightly above 5% in 1974 and increasing to as high 9.7% in 1982, eventually moderating back towards 5% throughout the rest of the decade.

For the purposes of this update, we will not attempt to unpack all the various fiscal, economic and geopolitical issues which contributed to this difficult period of stagflation which many of our clients and advisors lived through. However, it is important to highlight these key measurements along with the monetary responses.

Infamously, Arthur Burns was the head of the Federal Reserve (Fed) serving as the chairman of the central bank from 1970-1978. In response to the recession of 1970s, the Fed reduced the federal funds effective rate from ~9% to stagflationary low of 3.2% which many economic historians feel set the table for inflation to run rampant through the back half of the decade. As inflationary pressures increased, in response so did the (FFR) reaching approximately 13% in 1974. Monetary policy was volatile during Arthur Burns’ tenure, and in response to slowing inflation and another recession, the FFR was slashed once again to 5% before inflation re-accelerated.

Ultimately, to tame inflation it took new leadership at the Fed as Paul Volcker assumed the chairman’s role in 1979. Through a painful process of increasing the FFR to as high as 19%, Mr. Volcker is often credited with breaking the back of inflation in the early 1980s. With quotes such as “The standard of living of the average American has to decline” once he took on the role of leading the Fed, it is no wonder the term stagflation can so easily capture the mind’s imagination.

Where Are We Now?

Unsurprisingly the pandemic induced shutdown and subsequent fiscal/monetary policy responses dramatically impacted price and economic stability. Gradual normalization of inflationary pressures and economic growth has occurred, although uneven at moments. It is unrealistic to expect the process to occur in a linear fashion, which provides economic and financial commentators with plenty of eye-catching headlines.

Contrasting the current US economy with the 1970s/early 1980s is the most effective method to provide perspective on how stagflationary the current environment is. Beginning with the inflation data, it is true the March measurement was higher than market forecasters predicted. Economists expected a monthly increase of 0.3% month over month gain which would have equated to a yearly increase of 3.4%. Instead, the month over month increased 0.4% and 3.5% year over year.

From a wider perspective, the disappointing data was slight. In fact, since the disappointing April CPI data release, we have seen May figures which were in line with market expectations of continued moderation to 3.4%. Perhaps what gives consumers and investors consternation is these recent moderating elevated inflation rates come on the heels of historically low inflation measurements over a decade when central bank policy makers were more concerned about the threat of deflation.

Turning our attention to the economy and unemployment paints a distinctly different picture as well. GDP growth for the 1st quarter of 2024 disappointed at 1.6% which had slowed from the previous quarter’s annualized rate of 3.4%. Conversely, real GDP growth over the last year expanded at 3%, which is above the Fed’s long-term trend estimate of 2.1% through 2031. Additionally, the US unemployment rate continues to be quite low at 3.9%. Although higher than 2023’s trough of 3.4%, this labor market is quite different than the high unemployment rates of nearly 10% during the late 1970s.

Why could this time be different?

There is no argument that inflation is not receding as quickly as many of us would like. However, it is important to acknowledge the progress that has been made since inflation peaked at nearly 9% during the summer of 2022.

Additionally, the economy and employment market has remained resilient thus far. Under Fed chairman Jay Powell’s leadership, it seems the committee is determined not to make the same mistakes Arthur Burns did. Entering 2024, traders had been pricing in the possibility of 6-7 FFR cuts. Through it all, the Fed has remained resolute they will be data dependent on any new policy execution. Although inflation has moderated, it remains above the Fed’s explicit target of 2% on a core basis. In fact, the committee has recently jawboned the thought of potentially increasing rates further should the trajectory of inflation data re-accelerate. At the very least, the committee seems content to hold the FFR at current rates in the near term as they feel it is sufficiently restrictive to moderate economic activity and continue the progress made on price stability.

In conclusion we feel the fear of a stagflationary US economy like the 1970s is overwrought. There are many risks we consider when allocating client capital across a diversified portfolio. While we certainly do not want to be mischaracterized as pollyannish when considering the economic landscape as we continue to monitor risks, there are many factors which contribute to a stagflation outcome being a lower probability event in our view. In particular, a Fed committee who has seemingly learned the past lessons of easing monetary policy too quickly after an inflationary episode. Although higher than recent interest rates are painful for many, from a portfolio allocation perspective we see benefits for many clients as a result of investing in high quality sources of income to supplement current and future standards of living. One thing we know for certain, financial markets are ever changing and our goal is to pursue relative opportunities on behalf of our clients’ investment goals.

Click here to view our important disclosures.

FAS Market Update May 2024

The word “Stagflation” can strike fear into the hearts of consumers and investors. Painful memories of the 1970’s U.S. economy with its high inflation along with uneven growth quickly come to mind. Recent volatile inflation data and cooling GDP results have understandably resurrected these fears for many. Google searches for the term stagflation recently spiked after higher-than-expected March consumer price index measurements were released on April 10, 2024.

Source: Google search trends for the term “Stagflation”, 05/27/2024

Our FAS Wealth Partners update will discuss what occurred during the 1970s, where we are now with regards to the current economic landscape and why we feel the odds of a similar stagflationary environment are lower.

The 1970s

To begin we will spend most of this piece reviewing the inflationary backdrop experienced beginning in the 1970s through the early 1980s. Starting in 1968, inflation began to run at a rate of ~5% with 1972/1973 being notable exceptions until 1974 when inflation spiked to over 8%. From that year on, inflation was measured to be well over 5% reaching as high as 12.6% then receding to below 5% in 1983.

Over the same period, economic growth as measured by real GDP was significantly uneven with recessions occurring 4 times (shaded gray areas) between 1970 and 1982.

Additionally, unemployment was stubbornly high, jumping to 8.5% in 1975 from slightly above 5% in 1974 and increasing to as high 9.7% in 1982, eventually moderating back towards 5% throughout the rest of the decade.

For the purposes of this update, we will not attempt to unpack all the various fiscal, economic and geopolitical issues which contributed to this difficult period of stagflation which many of our clients and advisors lived through. However, it is important to highlight these key measurements along with the monetary responses.

Infamously, Arthur Burns was the head of the Federal Reserve (Fed) serving as the chairman of the central bank from 1970-1978. In response to the recession of 1970s, the Fed reduced the federal funds effective rate from ~9% to stagflationary low of 3.2% which many economic historians feel set the table for inflation to run rampant through the back half of the decade. As inflationary pressures increased, in response so did the (FFR) reaching approximately 13% in 1974. Monetary policy was volatile during Arthur Burns’ tenure, and in response to slowing inflation and another recession, the FFR was slashed once again to 5% before inflation re-accelerated.

Ultimately, to tame inflation it took new leadership at the Fed as Paul Volcker assumed the chairman’s role in 1979. Through a painful process of increasing the FFR to as high as 19%, Mr. Volcker is often credited with breaking the back of inflation in the early 1980s. With quotes such as “The standard of living of the average American has to decline” once he took on the role of leading the Fed, it is no wonder the term stagflation can so easily capture the mind’s imagination.

Where Are We Now?

Unsurprisingly the pandemic induced shutdown and subsequent fiscal/monetary policy responses dramatically impacted price and economic stability. Gradual normalization of inflationary pressures and economic growth has occurred, although uneven at moments. It is unrealistic to expect the process to occur in a linear fashion, which provides economic and financial commentators with plenty of eye-catching headlines.

Contrasting the current US economy with the 1970s/early 1980s is the most effective method to provide perspective on how stagflationary the current environment is. Beginning with the inflation data, it is true the March measurement was higher than market forecasters predicted. Economists expected a monthly increase of 0.3% month over month gain which would have equated to a yearly increase of 3.4%. Instead, the month over month increased 0.4% and 3.5% year over year.

From a wider perspective, the disappointing data was slight. In fact, since the disappointing April CPI data release, we have seen May figures which were in line with market expectations of continued moderation to 3.4%. Perhaps what gives consumers and investors consternation is these recent moderating elevated inflation rates come on the heels of historically low inflation measurements over a decade when central bank policy makers were more concerned about the threat of deflation.

Turning our attention to the economy and unemployment paints a distinctly different picture as well. GDP growth for the 1st quarter of 2024 disappointed at 1.6% which had slowed from the previous quarter’s annualized rate of 3.4%. Conversely, real GDP growth over the last year expanded at 3%, which is above the Fed’s long-term trend estimate of 2.1% through 2031. Additionally, the US unemployment rate continues to be quite low at 3.9%. Although higher than 2023’s trough of 3.4%, this labor market is quite different than the high unemployment rates of nearly 10% during the late 1970s.

Why could this time be different?

There is no argument that inflation is not receding as quickly as many of us would like. However, it is important to acknowledge the progress that has been made since inflation peaked at nearly 9% during the summer of 2022.

Additionally, the economy and employment market has remained resilient thus far. Under Fed chairman Jay Powell’s leadership, it seems the committee is determined not to make the same mistakes Arthur Burns did. Entering 2024, traders had been pricing in the possibility of 6-7 FFR cuts. Through it all, the Fed has remained resolute they will be data dependent on any new policy execution. Although inflation has moderated, it remains above the Fed’s explicit target of 2% on a core basis. In fact, the committee has recently jawboned the thought of potentially increasing rates further should the trajectory of inflation data re-accelerate. At the very least, the committee seems content to hold the FFR at current rates in the near term as they feel it is sufficiently restrictive to moderate economic activity and continue the progress made on price stability.

In conclusion we feel the fear of a stagflationary US economy like the 1970s is overwrought. There are many risks we consider when allocating client capital across a diversified portfolio. While we certainly do not want to be mischaracterized as pollyannish when considering the economic landscape as we continue to monitor risks, there are many factors which contribute to a stagflation outcome being a lower probability event in our view. In particular, a Fed committee who has seemingly learned the past lessons of easing monetary policy too quickly after an inflationary episode. Although higher than recent interest rates are painful for many, from a portfolio allocation perspective we see benefits for many clients as a result of investing in high quality sources of income to supplement current and future standards of living. One thing we know for certain, financial markets are ever changing and our goal is to pursue relative opportunities on behalf of our clients’ investment goals.

Click here to view our important disclosures.

Related Posts

FAS Wealth Partners Recognized Among Kansas City’s Employee-Owned Companies

Kansas City, MO – 10/22/2024 – FAS Wealth Partners proudly announces its inclusion in Kansas City Business Journal’s 2023 Employee-Owned Companies list, securing the #25 spot among 29 firms based

FAS Wealth Partners – KCBJ Investment Advisors List 2024 Press Release

FAS Climbs the Ranks: Now #12 on Kansas City Business Journal’s Investment Advisers List Kansas City, MO, September 6, 2024 — FAS Wealth Partners, a boutique wealth management firm in